Dietary Fiber Market to Reach USD 36.2 Billion by 2036, Expanding at 10.3% CAGR Amid Gut Health Revolution

Dietary fiber market growth accelerates as gut health trends, clean-label reformulation, and functional food innovation reshape global nutrition demand.

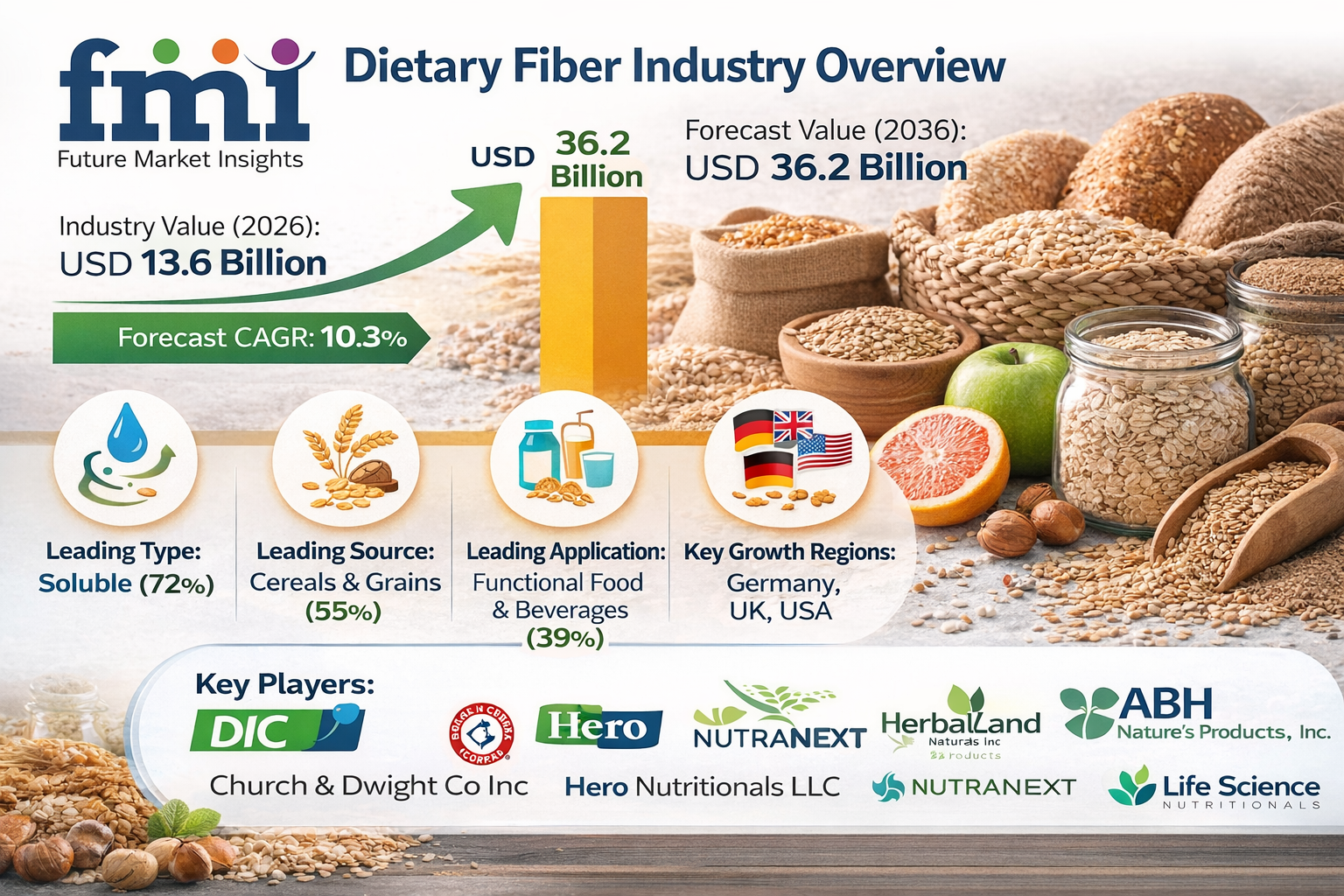

NEWARK, DELAWARE / ACCESS Newswire / February 11, 2026 / The global dietary fiber market is entering a decade of accelerated growth, with industry revenue anticipated to reach USD 13.6 billion in 2026 and forecast to expand at a CAGR of 10.3% through 2036. According to Future Market Insights (FMI), total market value is projected to approach USD 36.2 billion by the end of the forecast period.

Growth momentum is fueled by rising consumer awareness around digestive wellness, microbiome health, and preventive nutrition. Increasing demand for fiber-enriched bakery products, beverages, dairy alternatives, and supplements is reshaping ingredient sourcing and formulation strategies across the food and beverage value chain.

Manufacturers are investing in advanced processing technologies to improve solubility, sensory neutrality, and application stability-key performance parameters for next-generation fiber ingredients.

Market Snapshot

Metric | Value |

Industry Size (2026) | USD 13.6 Billion |

Forecast Value (2036) | USD 36.2 Billion |

CAGR (2026-2036) | 10.3% |

Leading Type | Soluble Fiber (72% Share) |

Leading Source | Cereals & Grains (55% Share) |

Leading Application | Functional Food & Beverages (39% Share) |

Production Economics: Yield Efficiency Driving Profit Margins

Maximizing extraction yield remains central to production economics. Advanced enzymatic hydrolysis technologies are increasing extraction yields by approximately 15%, directly lowering cost per metric ton of finished fiber.

Processing facilities handling cereal by-products aim for yield thresholds above 85% to maintain operational viability. Raw materials represent nearly 40% of total operating expenses, making efficiency improvements critical to sustaining competitive pricing for large FMCG clients.

Higher yield processes also reduce waste generation, supporting sustainability targets and ESG compliance frameworks increasingly demanded by multinational food brands.

Inventory Turnover: Protecting Freshness and Capital Efficiency

Inventory turnover ratios between 6 and 8 cycles annually are considered optimal among leading suppliers. Maintaining this range ensures the preservation of sensitive prebiotic compounds while reducing warehousing expenses by nearly 12%.

Efficient demand forecasting for seasonal crops prevents capital lock-in and enhances liquidity, allowing reinvestment in R&D initiatives focused on precision prebiotic blends and resistant starch technologies.

Compliance as a Competitive Advantage

Regulatory adherence remains non-negotiable in the dietary fiber landscape. Maintaining 100% compliance with GRAS standards, EFSA novel food regulations, and strict heavy metal limits significantly reduces recall risk-events that can cost up to USD 10 million per incident.

Automated quality control systems and transparent labeling practices are strengthening partnerships with multinational CPG companies that rely on validated health claims for product positioning.

Key Growth Catalysts

Several structural drivers are accelerating adoption across global markets:

Expansion of the "food as medicine" movement

Rising demand for gut-brain axis support ingredients

Growth in weight management and satiety-focused diets

Increased reformulation of sugar-reduced bakery and beverage products

Clean-label ingredient preference among millennials and Gen Z

Consumers increasingly justify premium pricing for fiber supplements and fortified foods that offer digestive and immunity support. "Invisible fortification"-clear, soluble fibers that maintain texture-has emerged as a critical innovation trend, particularly in beverage and dairy segments.

Segment Insights

Soluble Fiber Leads with 72% Share

Soluble fibers dominate the market due to formulation versatility and clinically supported health benefits. Ingredients such as inulin and digestion-resistant maltodextrin improve mouthfeel without grittiness and remain stable in acidic beverage systems.

Their role as sugar replacers in low-calorie formulations further strengthens segment leadership.

Cereals & Grains Account for 55% Share

Wheat, oats, and corn remain primary feedstocks due to abundant supply chains and established processing infrastructure. Upcycling initiatives-particularly brewer's spent grain-are transforming agricultural waste into high-value fiber ingredients, reinforcing circular economy objectives.

Functional Food & Beverages Command 39% Share

This segment benefits from increasing "snackification" trends and demand for convenient nutrition. Brands are incorporating low-fermentability fibers to achieve high-fiber claims while minimizing digestive discomfort.

Regulatory thresholds defining "good source of fiber" claims are directly influencing formulation decisions.

Market Dynamics

Weight Management as a Structural Driver

Resistant starch and specialty carbohydrates are gaining traction for their ability to reduce caloric density while maintaining texture. Satiety-enhancing formulations allow brands to position products within the weight-loss and metabolic health categories.

Sensory Challenges as Key Restraints

High fiber inclusion can result in dryness, grittiness, or off-notes, impacting repeat purchases. Masking technologies and sensory balancing agents add to production costs, challenging margin optimization.

Additionally, excessive fiber intake may cause gastrointestinal discomfort, limiting per-serving inclusion levels.

Clean Label Reshaping Product Development

Consumers increasingly prefer recognizable sources such as psyllium seed and whole-grain derivatives. Natural, non-GMO claims and traceable sourcing are becoming decisive purchase factors, particularly in European markets.

Country-Level CAGR Outlook (2026-2036)

Germany: 7.7%

UK: 7.1%

USA: 6.0%

France: 5.5%

Japan: 5.4%

Germany leads European growth, driven by organic consumption trends and vegan product innovation. The UK market benefits from public health initiatives promoting fiber intake.

In the United States, digestive health awareness and convenience-driven consumption fuel steady expansion. Keto-friendly and low-carb fiber formats are gaining traction.

Japan's FOSHU regulatory framework supports fiber-enriched functional beverages targeting blood sugar management and healthy aging demographics.

France leverages Nutri-Score labeling incentives, encouraging manufacturers to boost fiber content while preserving traditional sensory profiles.

Competitive Landscape Intensifies

The market is consolidating as leading players pursue vertical integration and biotech acquisitions to strengthen prebiotic portfolios. DIC Corporation holds a dominant 18.3% market share, leveraging global scale and sustainable extraction technologies.

Strategic partnerships with agricultural cooperatives secure raw material consistency, mitigating crop volatility risks. Meanwhile, new entrants are repurposing industrial cellulose for food-grade applications, increasing competitive pressure.

Clinical validation, formulation support services, and sustainability credentials are emerging as key differentiators in supplier selection.

Key Players

DIC Corporation

Church & Dwight Co Inc

Hero Nutritionals LLC

Nutranext

Herbaland Naturals Inc

ABH Nature's Products, Inc

Life Science Nutritionals

As consumer expectations evolve toward science-backed, clean-label nutrition, the dietary fiber market is positioned for sustained double-digit growth. Innovation in extraction efficiency, compliance excellence, and functional application design will determine long-term leadership across this rapidly expanding global industry.

For an in-depth analysis of evolving formulation trends and to access the complete strategic outlook for the Dietary Fiber Market through 2036, visit the official report page at: https://www.futuremarketinsights.com/reports/dietary-fibres-market

Browse Related Insights

Food Dietary Fibers Market: https://www.futuremarketinsights.com/reports/food-dietary-fibers-market

Dietary Fiber Gummies Market: https://www.futuremarketinsights.com/reports/dietary-fiber-gummies-market

Insoluble Dietary Fiber Market: https://www.futuremarketinsights.com/reports/insoluble-dietary-fiber-market

Low-Fermentability Dietary Fibers Market: https://www.futuremarketinsights.com/reports/low-fermentability-dietary-fibers-market

Dietary Supplement Market: https://www.futuremarketinsights.com/reports/dietary-supplements-market

About Future Market Insights (FMI)

Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. Headquartered in Delaware, USA, with a global delivery center in India and offices in the UK and UAE, FMI delivers actionable insights to businesses across industries including automotive, technology, consumer products, manufacturing, energy, and chemicals.

An ESOMAR-certified research organization, FMI provides custom and syndicated market reports and consulting services, supporting both Fortune 1,000 companies and SMEs. Its team of 300+ experienced analysts ensures credible, data-driven insights to help clients navigate global markets and identify growth opportunities.

For Press & Corporate Inquiries

Rahul Singh

AVP - Marketing and Growth Strategy

Future Market Insights, Inc.

+91 8600020075

For Sales - [email protected]

For Media - [email protected]

For web - https://www.futuremarketinsights.com/

SOURCE: Future Market Insights, Inc.

Information contained on this page is provided by an independent third-party content provider. XPRMedia and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]